Something Cassie and I have done every January that we’ve been married is schedule a day to do a financial review of the previous year and spend some time dreaming up and planning for the new year.

We always dedicate at least a few hours, and usually a full day, to this conversation so that it’s not rushed and we can really talk about what we want out of the next year. We’ll usually start the day with a walk, make some coffee, and then dive in. We try to make it a healthy mix of fun and casual conversation while also getting some simple stuff done and figuring out next steps.

This meeting helps us turn our hopes for the upcoming year into reality and get on the same page about our financial priorities for the year. Here’s a short list of things that have come out of these conversations:

- The idea and plan for my “sabbatical”

- The decision to not move and stay where we are for a few more years

- The choice to prioritize travel to see friends and family over specific destinations this past year (while still planning a long weekend away just us)

- Updating our investment contribution amounts for the upcoming year

- Deciding which house projects take priority for that year

- Planning an incredible 3 week trip to Japan for our upcoming 10 year anniversary

Today I wanted to share with you the specific meeting agenda we follow for these conversations, so you can adapt it for your life and have your very own meeting.

Highlights of the year!

We always start with sharing a few of our highlights from the past year. Usually we talk about this during our morning walk. You can keep it general or give specific categories such as:

- What was your favorite trip we took?

- What was your favorite meal we ate?

- What was the best thing we bought this year?

- What were some of your favorite ways to spend time?

- What was your favorite date night?

These are some of the categories we usually use, because we love travel and food, but you can make it more specific to the things you love to do together – like what was your favorite new board game, concert, hike, or play.

Review Annual Spending, savings, Investments, and Net Worth

It’s important to have a sense of how you spent your money the previous year so that you have a starting point to decide if you are happy with the spending or want to make some changes – in either direction.

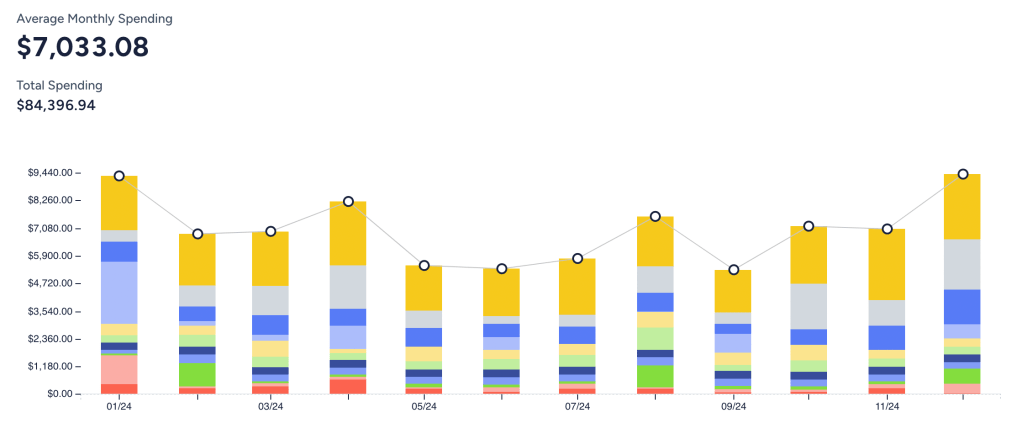

I prep this information ahead of time so that we’re not wasting time digging through a spreadsheet and it can be more of a conversation. We look at our total overall spending, and how it breaks down in various category groups.

We use YNAB to track and plan our spending throughout the year so this information is already easily available in nice charts and graphs. And it makes it easy to do a quick gut check if spending in any one category feels too high or low (sometimes your gut is wrong, or just not living in reality though). We wait to dig into any changes we may want to make til the next section of the agenda.

After taking a look at our spending, we take a look at our bigger picture financials. Our savings rate, our investment contributions and balances, and our total net worth.

This is a great opportunity to celebrate the wins you’ve had toward your goals over the past year.

Making Changes: What went well? What didn’t go well?

Next up we start discussing some specific questions about the past year and make any necessary changes for the upcoming year. We try to cover three realms: Finances, Time, and Household.

Financially: Is there anything we want to spend more on this year? Is there anything we want to spend less on in order to prioritize something else? Are there upcoming income changes we should take into account when planning? Can we increase our investment contributions? Are there any subscriptions we should cancel? Is there something we could spend money on to make our lives easier?

Time: Did we feel too busy or not have enough going on? Did we feel like we had enough social, alone, connected time? If not, what can we do to have a better balance?

Household: How do we feel about splitting household labor? Do changes need to be made?

Mid to long term savings goals

Based on our previous answers, we take some time to discuss our mid-to-long-term savings goals. We decide if they are still important to us or if they may have moved down the priority list or been replaced by a new goal (its okay if your goals/plans change!). For example, two years ago we saving for an out-of-state move, but at the start of last year we decided that wasn’t part of the plan for now.

Some of our mid-term savings goals in the past have included a new mattress, a new air conditioner, taking three months off work and traveling, and family planning. Plus we are always investing for retirement and planning 4-6 trips a year.

Your savings goals should always be specific to you. Not what you think you should be saving for.

Once we decide what we are saving for, we’ll see if we are on track, and make any adjustments to the savings targets in YNAB.

Travel Plans!

This next section is my personal favorite! We figure out what trips we definitely want to take for the upcoming year and make sure we can make them happen.

We talk about what kind of travel is on our wishlist for the year – maybe it’s a romantic getaway, or traveling for a friend’s wedding, visiting a new city to catch our favorite band, meeting up with college friends, or taking an adventure to a destination we’ve never been to.

Once we know what we want to do, we see where it fits in during the year and put it on the calendar. If it’s not on the calendar, it doesn’t happen. Some trips have fixed dates – if they are attached to a wedding or concert, but others we’ll just decide the general time of year or month we want to go.

Finally we dream up how we want to experience those trips – do we want to stay in a nicer place, get a big airbnb with room to invite people to join, or stay in a hostel? Are we making reservations for nice restaurants or sticking to cheap eats? Will we need a rental car? What things do we want to do while we’re there to make it extra special?

Answering all these questions helps us come up with a budget for each trip – we can set a target in YNAB and it will tell us how much we need to set aside each month so we’ll have enough for our ideal trip when the travel time comes around and not have to stress about the bill when we get home.

At the end of last year we became foster parents, so we’ll also be figuring out childcare if it’s needed.

Optional: Bonus Money

If you have a job where you get an end of year bonus, this is a great chance to discuss what you want to do with that money. Max out your Roth IRA? Add some buffer to your emergency fund? Buy that thing for the house you’ve had your eye on? Set it aside for a vacation? Some combination?

It might also be a good idea to establish a percentage based rule for all future bonuses. For example: 50% gets invested, 20% gets saved, and 30% gets spent on your choosing.

Think about it intentionally, make a decision, and implement it.

What’s one thing you’re grateful for that your partner contributes to your shared life?

I always like to end with a moment of gratitude for each other. Share something that you appreciate that your partner does that helps make your shared life amazing.

We often think of contribution in the financial sense – but we each contribute to our relationship in so many ways. It might be your vacation planning skills, or your outside of the box thinking, or your emphasis on making things fun, or that you always have one eye on the future. Let your partner know what special traits, skills, or mindset they bring to the table that benefits you both.

Review Your To Do List and Schedule Your Next Meeting!

Finally, you’ll end the meeting with a short to do list to help make your plan a reality. This list might look something like this:

- Cancel that one credit card with an annual fee

- Cancel that one subscription you forgot about and no longer use

- Book plane tickets for Trip A

- Book hotel and rental car for Trip B

- Open a high yield savings account

- Setup YNAB categories and targets for all new trips/goals

- Increase retirement contributions by 3%

- Price out how much it would cost to have a house cleaner once a month

- Pick a date for the next party you’ll throw

If some of the things are quick and can get done now, just do them now, don’t wait. Anything that will take a bit longer, assign to one of you and schedule a date for the next month to follow up and check-in.

And that’s it! I encourage you to take this agenda as a starting point, tweak it to make it your own, and try out having your own financial review and planning meeting to start off the New Year. I promise, you’ll be glad you did!

Let me know what you’d change for your own agenda! And if you and your partner are looking for help getting on the same page financially and making some progress towards making your dream year a reality, check out my coaching offerings – I’d love to help out.

Leave a comment